Project Details

The solution has also won the prestigious National Innovation Award showing the high level of acceptability.

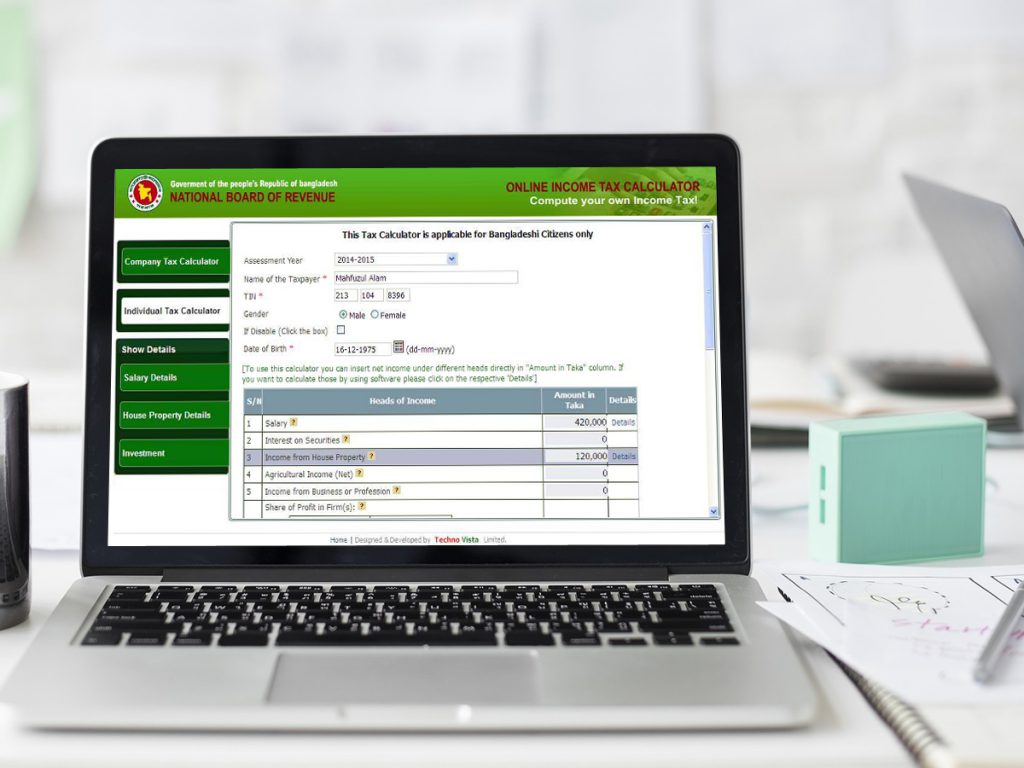

Income Tax Calculator is to provide a service to the individual and corporate taxpayer to help tax calculation and preparing their income tax return. Income tax calculation and preparation of tax return is a complex task for a non-professional.

To make the IT return form user friendly, tax calculator would be a tool which leads to the taxpayers to reach their total income in steps and auto calculation of net tax amount to be paid. The tool will help the taxpayers to calculate income tax and prepare the IT return is more easily and accurately.

This solution is a self explanatory. Lots of instructions with balloons and a user manual including screen shots are provided there. Anyone can be able to calculate their own income tax and prepare their IT return with the help of guidelines and user manual.

Other Modules

- Income Tax Calculator for Individual Taxpayers

- Income Tax Return Preparation for Individual Taxpayers

- Income Tax Calculator for Company Taxpayers

- Generation of guideline to reach a corrected total income of the concerned assessment year

- Generation of online registered & unregistered users access facility

- Generation of data storage facility of registered users

- Automatic tax calculation & rebate calculation

- Generation of Reports

Features & Benefits

- Presentation of IT Return form in very much user friendly for the taxpayers

- Necessary guidelines the taxpayer’s to input the information regarding his income to reach to a correct total income of the concerned assessment year

- Identification the contradictory inputs which are apparently wrong and guide to correct the same

- Automatic tax calculation against total income by taxpayer type at normal tax rate/slab

- Taxpayer type wise automatic exemption calculation

- Taxpayer type wise automatic Investment rebate calculation

- Preparation of Net payable tax considering total income, Tax payable & total rebate in accurately