Project Details

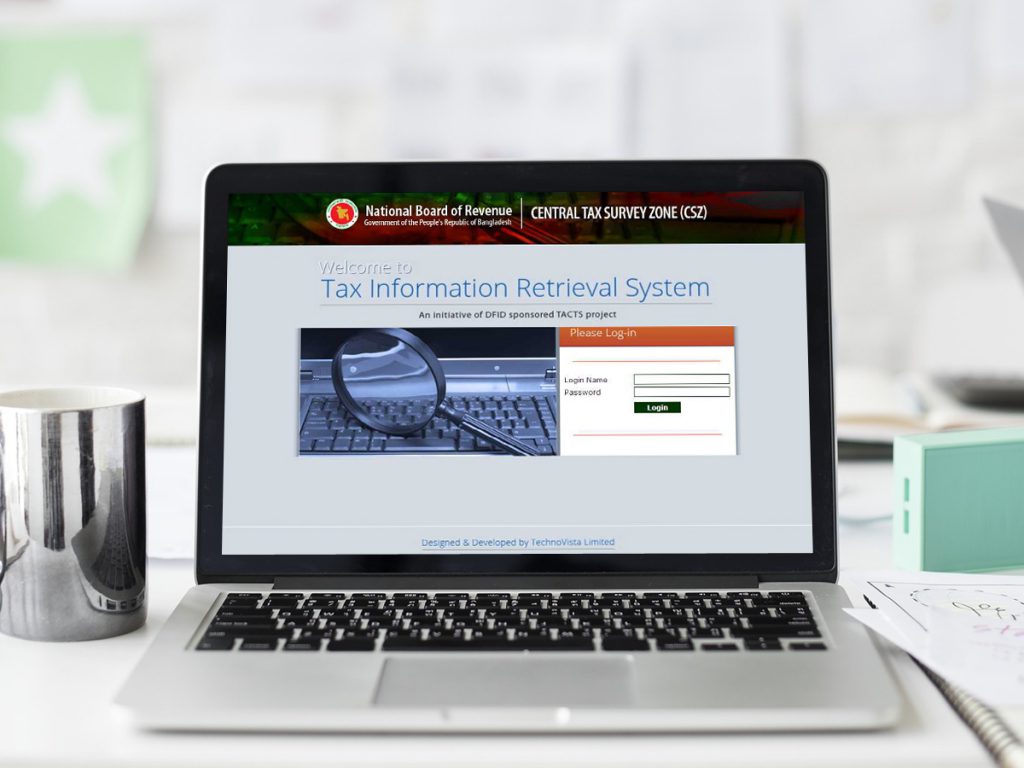

The Tax Information Retrieval System (TIRS) is an initiative by Central Survey Zone, NBR intended to securely exchange the Taxpayer’s information electronically between stakeholders and Taxes Circle’s communities.

The main functionalities of the Central Survey Zone (CSZ) are to conduct and monitor survey program throughout Bangladesh to increase the income tax base and identify new prospective taxpayers.

The target of this software is to reduce the manual filing and record-keeping process, as well as to improve the operational efficiency along with availability of data in the quickest possible time. Thus, it will improve the effectiveness and performance efficiency of CSZ employees. This system also targets to collect information correctly and speedily from different stakeholders on a weekly, quarterly, monthly or yearly basis. The system is expected to generate all the required reports to help the authority to decide issues on time.

Other Modules

- User Access Management

- Taxpayer’s Information Uploading

- Taxpayer’s Information Data Entry

- Taxpayer’s Information Receive for Circle Action

- Circle Action

- Taxpayer Information search

- Query & Reporting

- Audit Trail

Features & Benefits

- Authorize user login option into the TIRS web portal

- Unique data collection format generation for all stakeholders

- Backlog Taxpayer data entry/data upload information

- Receive Taxpayers information for Circle Action

- Circle Action

- Taxpayers Circle Transfer information

- Filtering Taxpayer information according to corresponding Taxes Zone/Circle/Area etc

- View Taxpayer information depending on different parameters

- Generate varies reports based on TIN, Zone, Circle, Source, District, Area for audit or action purpose.

- Generate MIS reports